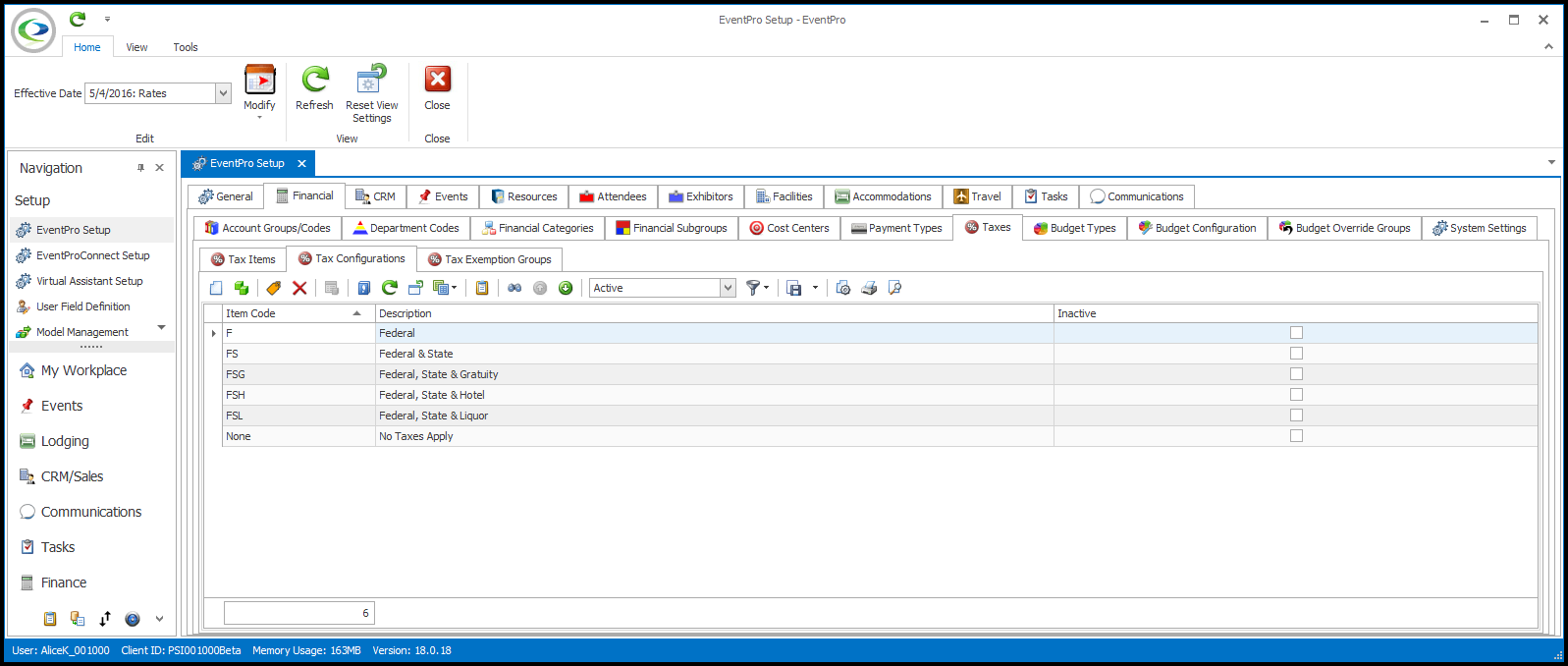

•You need to create Tax Configurations for each possible combination of Tax Items that could apply.

•For example, if you have a Tax 1, Tax 2 and Tax 3, any of which could be applied together, you'd have to create tax configurations representing each combination (1, 2, 3,1+2, 2+3, and so on), as well as a configuration with no applicable taxes, for situations where no taxes apply.

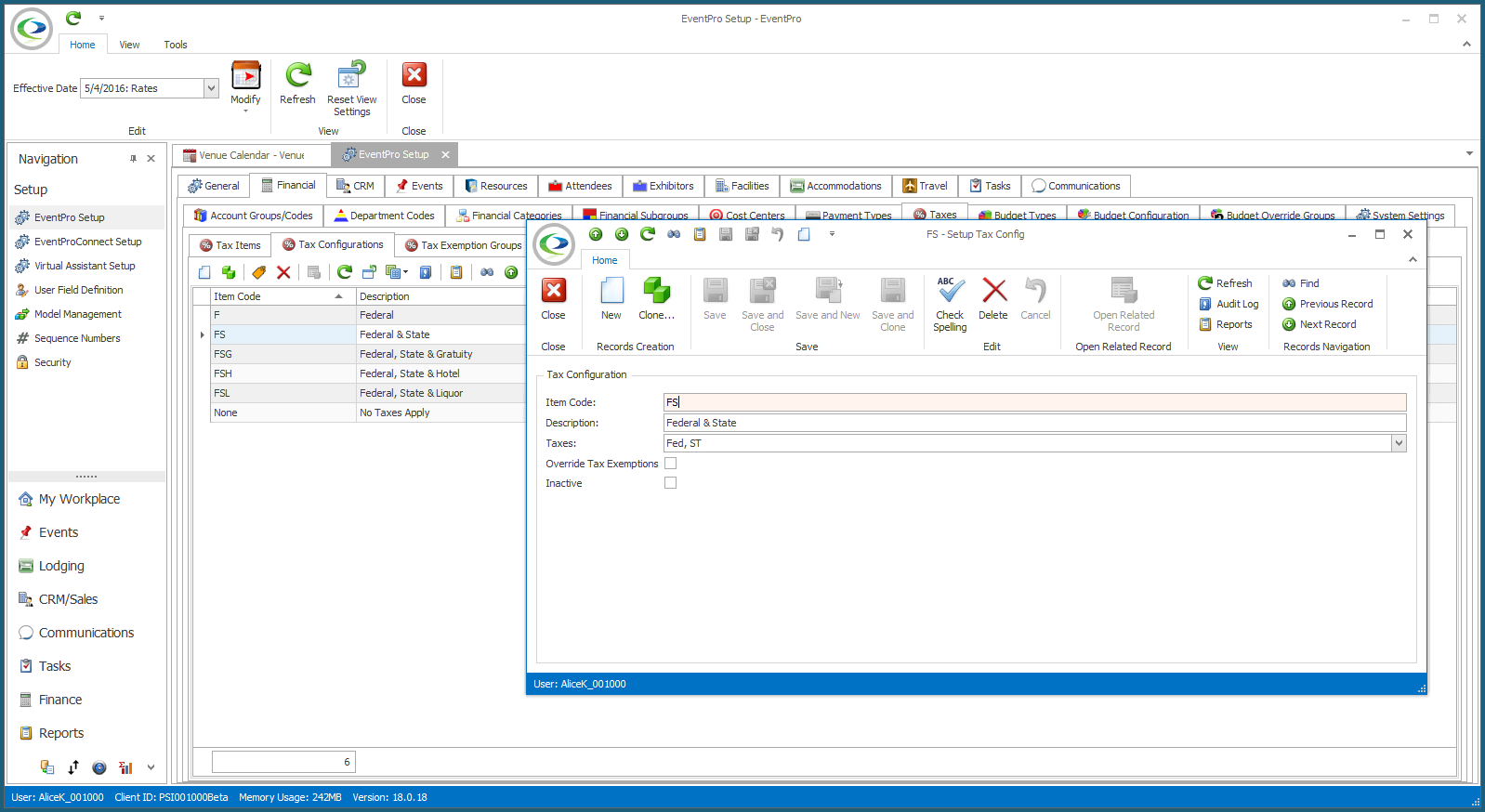

1.Go to the Tax Configurations tab, and start a new record or edit an existing record.

2.The Setup Tax Config edit form opens.

3.Item Code: Type in the item code for this configuration of taxes. For example, you could use the Indicator character for each of the taxes in the configuration.

4.Description: Enter a description of this tax configuration.

5.Taxes: From the drop-down list, select the taxes that are applied for this configuration. If the tax you want to apply does not appear in this drop-down list, ensure that you have added the tax items in the Tax Items tab.

6.When you're done creating or editing the Tax Configuration, click Save and Close.