•To best explain the purpose of Tax Exemption Groups, we should first review how general Event Tax Exemptions work.

oIn the Edit Event Window, you can apply Tax Exemptions at the Event level so that everything in that Event is exempt from selected Taxes.

oThe Event Tax Exemptions may even default in during the booking process, since you can set default Tax Exemptions on a CRM Company or Contact, and those defaults will be pulled through to Events booked for that Company or Contact.

oHowever, you may encounter a situation where an Event Tax Exemption is too broad. In some situations, only certain Event Resources may be tax-exempt, while other Event Resources must be taxed.

▪For example, let’s say that certain "Non-Profit Fundraising" events in your jurisdiction are exempt from State Tax, except for Catering Items, which must still have State Tax applied.

▪Selecting “State Tax” as the Tax Exemption for an entire Event would be too broad, as you still need State Tax charged on Event Catering.

▪Instead, you would create a Setup Tax Exemption Group that excludes State Tax from all Financial Subgroup Types except for “Catering”. (Although we are using Financial Subgroup Types for this example, you can narrow down the exemptions to your user-defined Financial Subgroups, if you want.)

▪You would then apply that Tax Exemption Group to the relevant "Non-Profit Fundraising" events, and/or the Companies/Contacts who book those types of events.

•Therefore, these Tax Exemption Groups are intended for use in Events where a blanket Tax Exemption in Edit Event would be too broad.

oYou can assign a Tax Exemption Group for an applicable event in Edit Event.

oYou can also assign a Tax Exemption Group at the CRM Account (Company/Contact) level. If you book an Event for that Account as Event Client, the Tax Exemption Group will be pulled through to the Event.

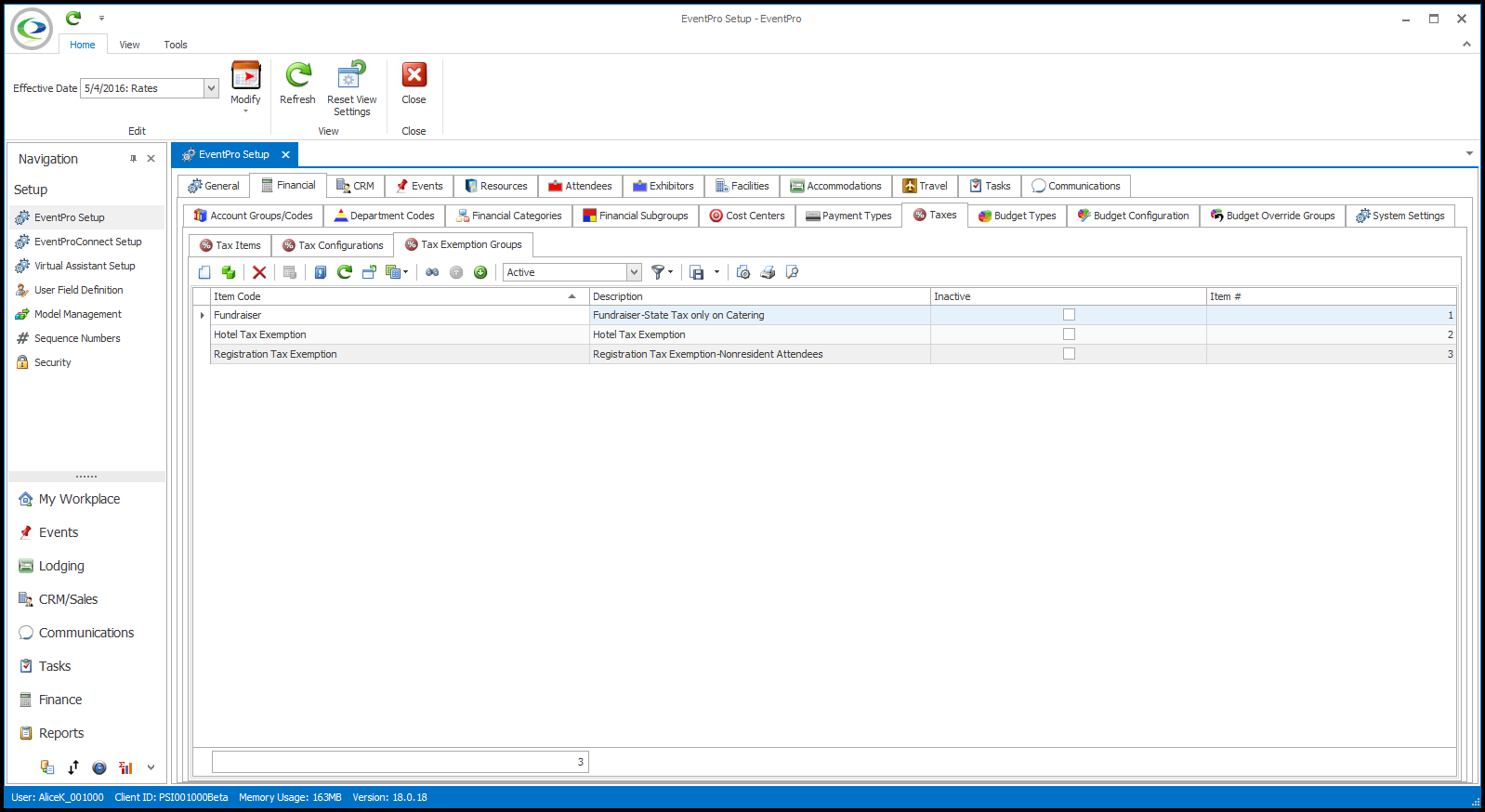

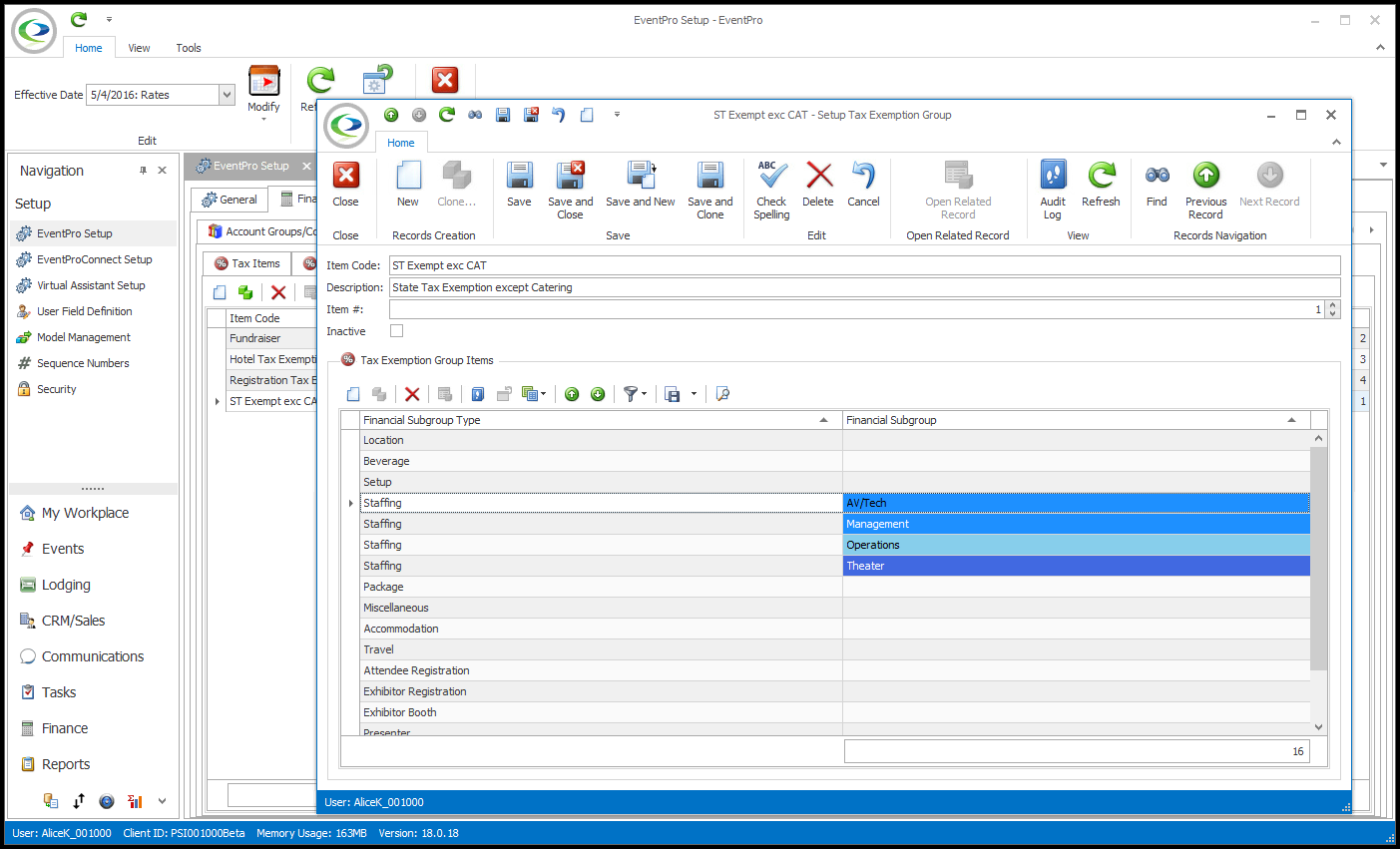

1.To define a new Tax Exemption Group, start a new record under EventPro Setup > Financial > Taxes > Tax Exemption Groups.

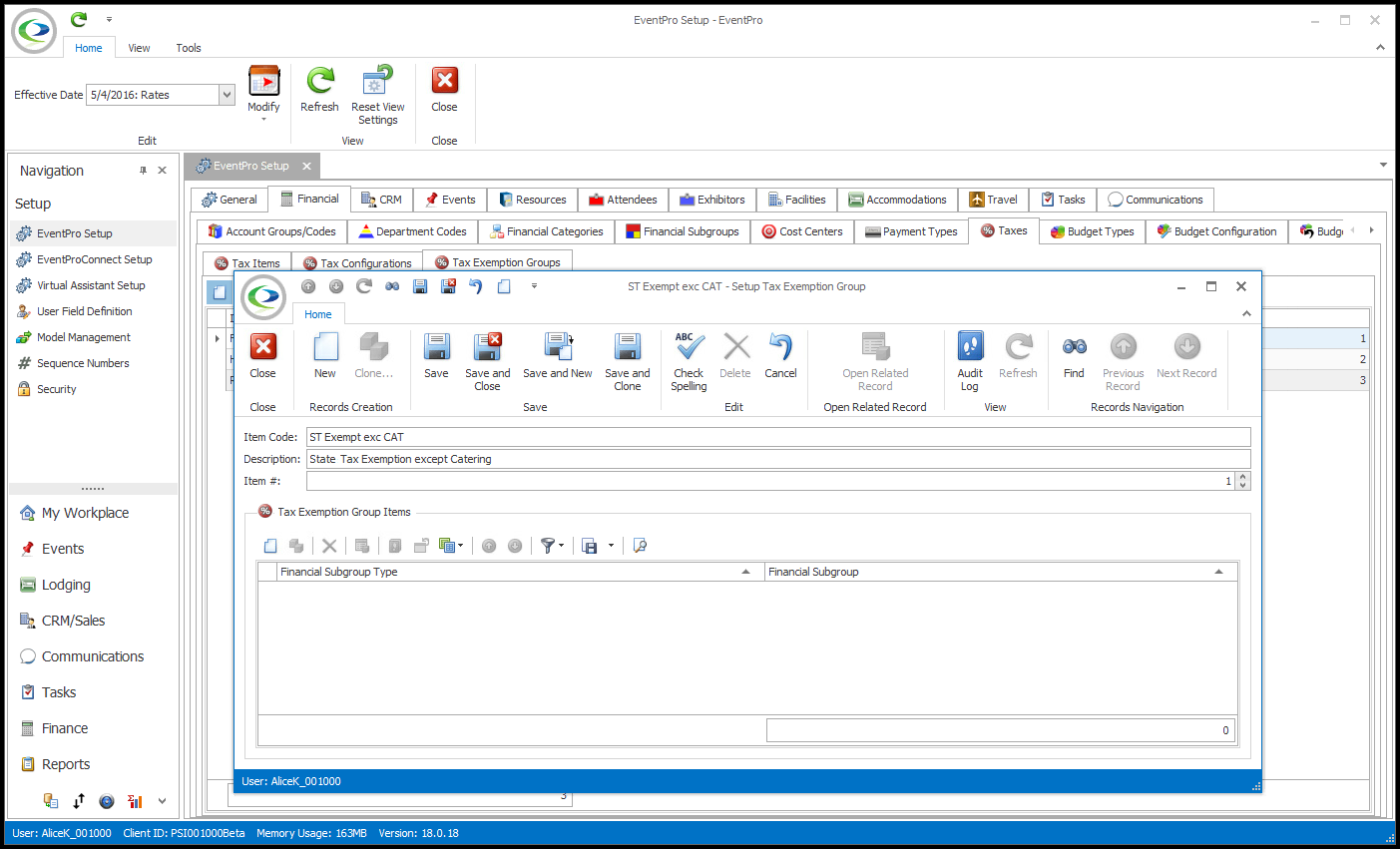

2.The Setup Tax Exemption Group edit form appears.

Enter the Item Code and Description for this Tax Exemption Group.

3.In the Tax Exemption Group Items selection grid, you will define the Tax Exemptions that apply to certain Financial Subgroup Types and/or Financial Subgroups for this Tax Exemption Group.

Start a new record in the Tax Exemption Group Items selection grid.

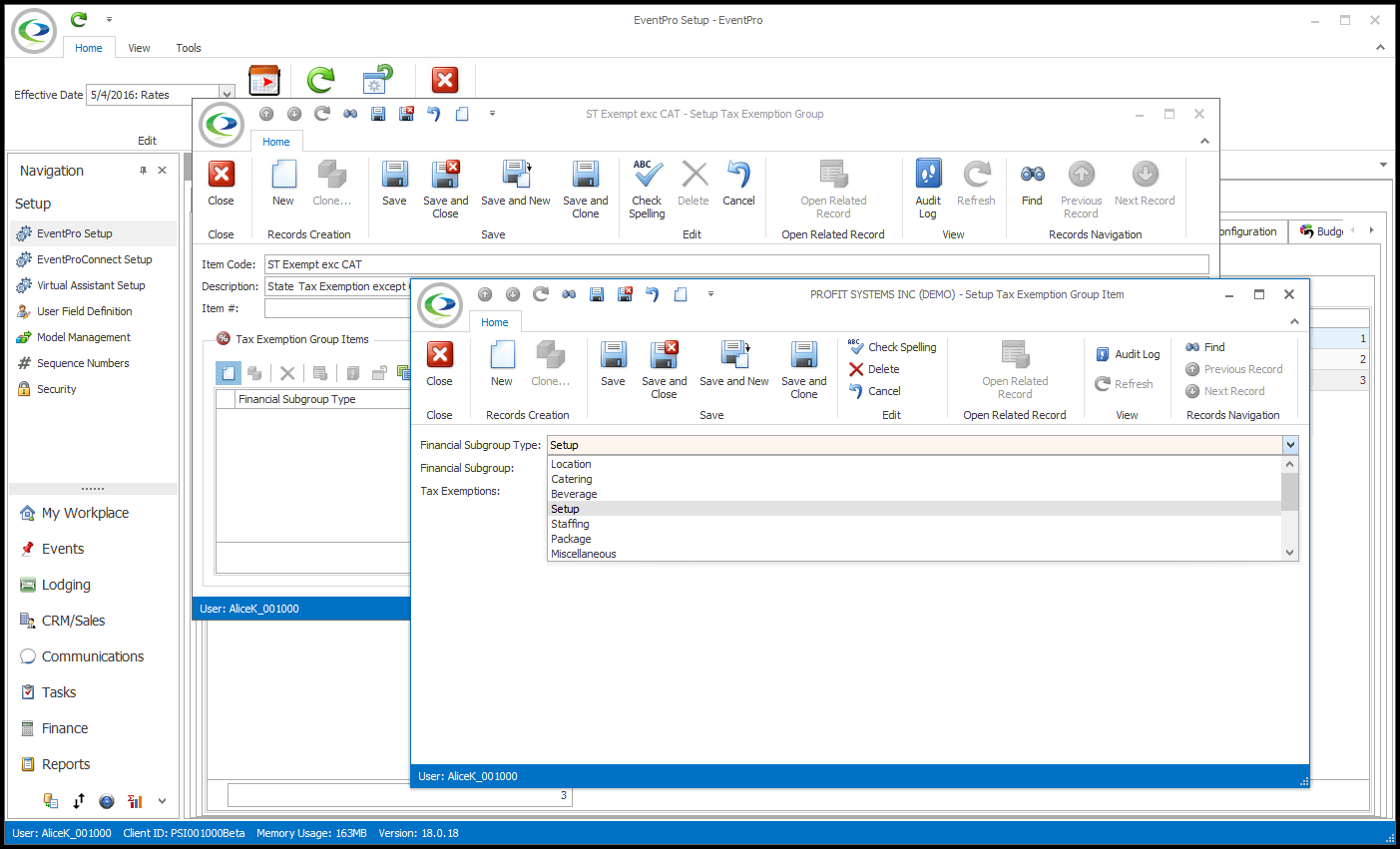

The Setup Tax Exemption Group Item edit form appears.

4.Select the Financial Subgroup Type to which you plan to apply Tax Exemptions.

Remember that these Financial Subgroup Types are hard-coded in EventPro Software, not user-defined like Financial Subgroups.

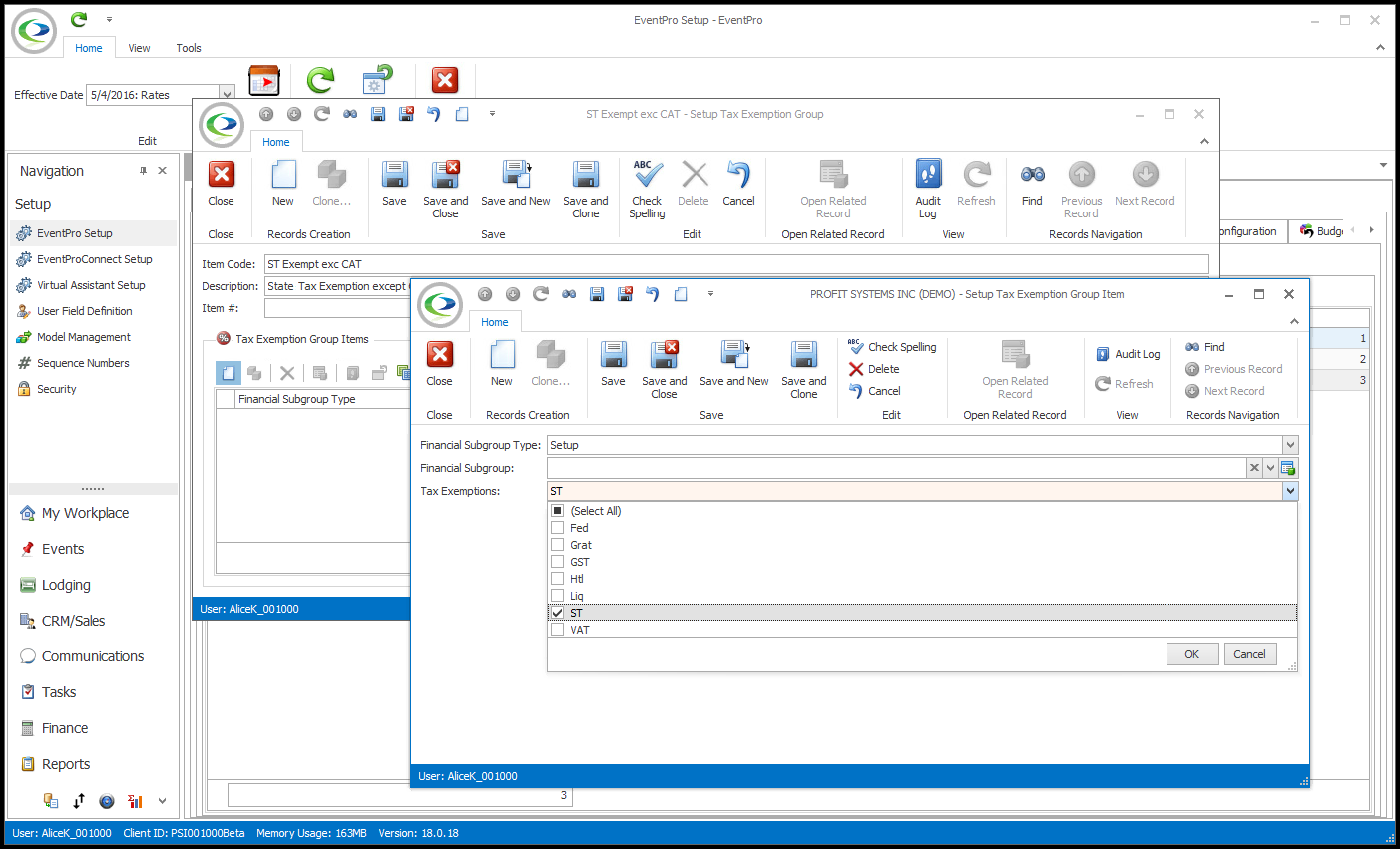

5.If you want to further narrow down the tax exemption, you can select a Financial Subgroup within the Financial Subgroup Type. Remember, these Financial Subgroups are user-defined under EventPro Setup > Financial > Financial Subgroups.

It is not necessary to define the Tax Exemption down to the Financial Subgroup level if the exemption applies to the entire Financial Subgroup Type.

6.Select the Tax Exemptions for the Financial Subgroup Type/Financial Subgroup selected above. Click OK.

7.Save and Close the Setup Tax Exemption Group Item edit form to return to the Setup Tax Exemption Group edit form.

8.Continue adding tax exempt Financial Subgroup Types and/or Financial Subgroups to the Tax Exemption Group, as required.

9.When you are done defining the Tax Exemption Group, click Save and Close in the Setup Tax Exemption Group edit form.

10.Continue creating any other Setup Tax Exemption Groups you require.

11.As noted above, you can apply a Tax Exemption Group to an Event (in Edit Event Window > Financial), or to a CRM Company or Contact.