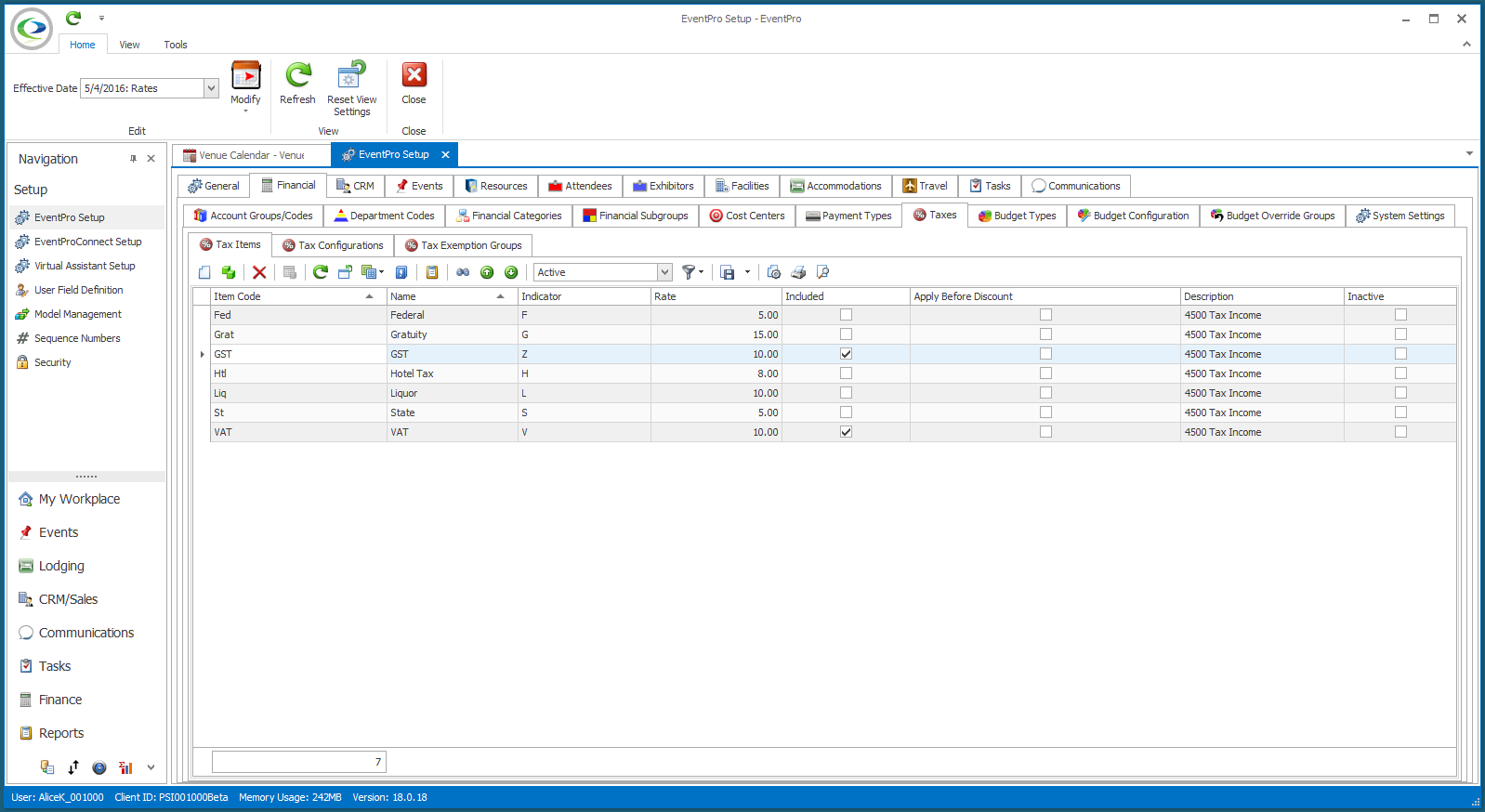

•Under Setup > Financial > Taxes, you define the taxes you will charge your clients.

•Taxes are set up on two levels:

oFirst, under Tax Items, you define individual taxes. You can create as many different taxes as you may require.

oSecond, under Tax Configurations, you group the individual taxes in different combinations. You can also create as many different tax configurations as you need.

See the instructions under Setup Tax Items and Setup Tax Configurations below.

•You also have the option to create Tax Exemption Groups. Tax Exemption Groups are used when tax exemptions are required on some resources in an Event, but an overall Event Tax Exemption is too broad. This is explained in further detail under Setup Tax Exemption Groups.

Previous Version Note: If you used previous versions of EventPro Software, you will notice that Tax Setup no longer uses the "checkbox" system, where you defined 6 tax rates and applied them to various items by selecting the checkboxes. Now, you can now create an unlimited number of tax rates, and group taxes together into as many configurations as you need for the various combinations of taxes you may have to charge.