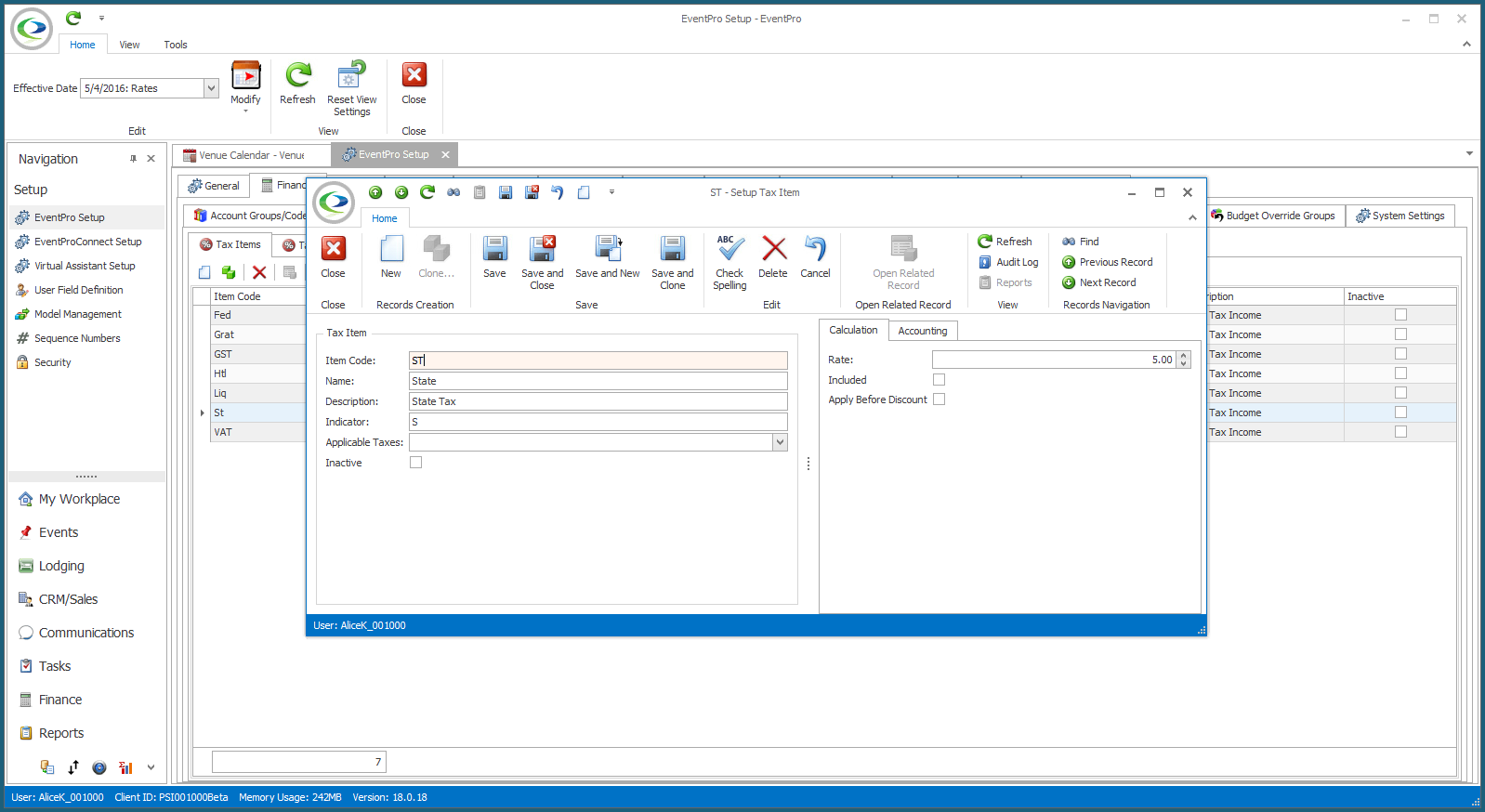

1.Go to the Tax Item tab, and start a new record or edit an existing record.

2.The Setup Tax Item edit form opens.

a.Item Code: Type in the item code for this tax, typically a shortened form of the tax name.

b.Name: Enter the name of the tax.

c.Description: Enter a longer description of the tax, if you like.

d.Indicator: Enter a 1-character indicator for the tax.

e.Applicable Taxes: If other taxes are applied to this tax you are creating, select the tax(es) from the Applicable Taxes drop-down list.

Note that you should create those taxes first so that they appear in this drop-down list.

4.Calculation

a.Rate: Enter a rate for the tax. Tax rates are percentages.

b.Included: Select this checkbox if the tax is inclusive.

i.If the tax is built into the price, it is inclusive, and you will check the Included checkbox.

ii.If you will add tax to the price, it is not inclusive and you do not check the Included checkbox.

c.Apply Before Discount: Select this checkbox if this tax will be charged on before-discount amounts.

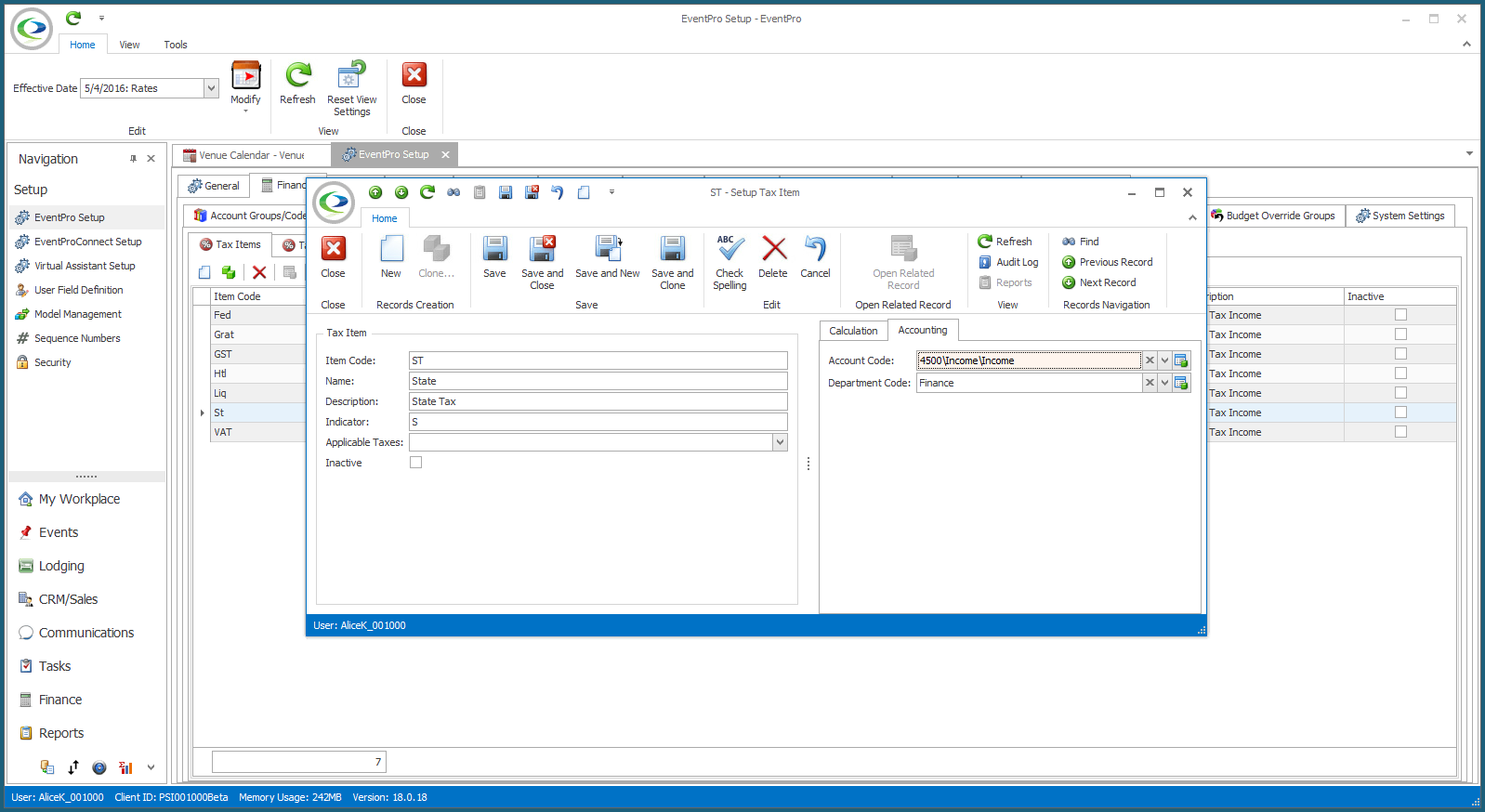

5.Accounting

a.Account Code: Select the account code to which this tax belongs.

You created these Account Groups and Account Codes earlier in the setup process.

b.Department Code: If applicable, select the department code that applies to this tax.

You created Department Codes earlier in the setup process.

6.When you're done creating or editing the Tax Item, click Save and Close.

7.When you have created as many Tax Items as you need, you can create Tax Configurations for each possible combination of taxes that could apply. See Setup Tax Configurations.