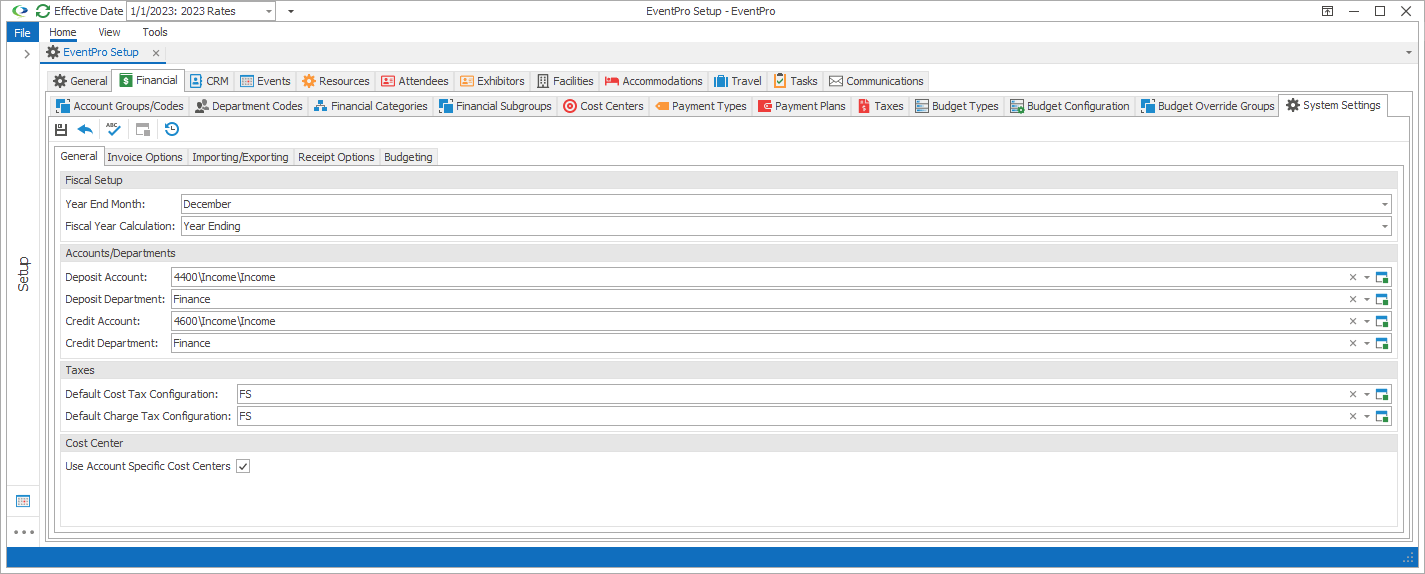

Figure 439: General Settings

Fiscal Setup

Year End Month

From the drop-down list, select the month that represents the end of your fiscal year.

Fiscal Year Calculation

If your fiscal year splits over two years (for example, August 2015 to July 2016), choose from the drop-down list whether you want the fiscal year to be determined by the Year Starting (2015 in the example) or the Year Ending (2016 in the example).

Accounts/Departments

Select the default account or department from the following drop-down lists:

•Credit Account

•Credit Department

You created your Account Codes and Department Codes earlier in setup.

Taxes

The Tax Configurations you can select in the following drop-down lists would have been created earlier under the topic Taxes / Setup Tax Configurations.

Default Cost Tax Configuration

When creating new records in Setup - such as Resources, Venue Locations and Hotel Room Types - the Tax applied to the Cost will default to the Tax Configuration you select here.

Default Charge Tax Configuration

When creating new records in Setup - such as Resources, Venue Locations and Hotel Room Types - the Tax applied to the Charge will default to the Tax Configuration you select here.

Cost Center

Use Account Specific Cost Centers

Select this checkbox if you want to use cost centers that are specific to "Accounts", i.e. Companies and Contacts in CRM.

If you select this checkbox, when you create an account (a company or contact), you can select which Cost Centers from EventPro Setup are applicable to that particular company or contact. When you later book an event for that account (company/contact), you will only be able to choose a cost center from the list of those you assigned to the account in the account's setup.

Save Changes

When you make any changes to these settings, ensure that you click Save above the General sub-tab.

Next Topic: Invoice Options